A) Move equilibrium to QF.

B) Eliminate the GDP gap because of the increase in output.

C) Move equilibrium to point Y where the price level is higher than before.

D) Move the economy to point Y and then the market mechanism will move the economy to point Z.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be a policy option to eliminate an AD shortfall?

A) Increase government purchases.

B) Reduce taxes.

C) Reduce transfer payments.

D) Increase transfer payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of additional aggregate demand needed to achieve full employment after allowing for price level changes is

A) The AD shortfall.

B) The AD excess.

C) The recessionary GDP gap.

D) The inflationary GDP gap.

Correct Answer

verified

Correct Answer

verified

True/False

If the economy is experiencing excess demand that is causing inflation,the inflationary pressures can be eliminated by reducing government spending by less than the amount of excess demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

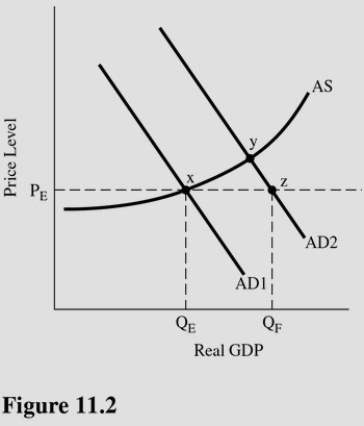

Assuming QF is the full employment equilibrium then a shift from AD1 to AD2 in Figure 11.2 will

Assuming QF is the full employment equilibrium then a shift from AD1 to AD2 in Figure 11.2 will

A) Worsen the existing unemployment problem.

B) Reduce,but not close,the GDP gap.

C) Cause significant inflation.

D) Eliminate the GDP gap.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the multiplier equals 2 and the AD shortfall is $6 million,the desired fiscal stimulus is

A) $6 million.

B) $12 million.

C) $333,333.

D) $3 million.

Correct Answer

verified

Correct Answer

verified

True/False

A $500 increase in government spending contains more fiscal stimulus than a $500 tax cut.

Correct Answer

verified

Correct Answer

verified

True/False

Fiscal policy formation is typically a quick process.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

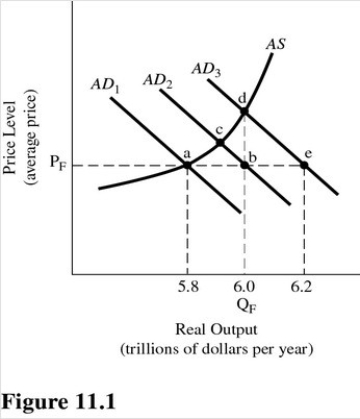

Refer to Figure 11.1.Assume aggregate demand is initially represented by AD1 and full-employment output is $6.0 trillion.If aggregate demand increases by the amount of the GDP gap,equilibrium will occur at

Refer to Figure 11.1.Assume aggregate demand is initially represented by AD1 and full-employment output is $6.0 trillion.If aggregate demand increases by the amount of the GDP gap,equilibrium will occur at

A) Point a.

B) Point b.

C) Point c.

D) Point d.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The crowding out effect refers to a decrease in

A) Consumption or investment as a result of an increase in government borrowing.

B) Investment resulting from an increase in consumption and a decrease in savings.

C) Government spending resulting from a decrease in taxes.

D) Consumption resulting from an increase in investment.

Correct Answer

verified

Correct Answer

verified

True/False

An income transfer contains less fiscal stimulus than an increase in government spending of the same size.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal restraint is defined as

A) Tax hikes or spending cuts intended to reduce aggregate demand.

B) Tax hikes or spending cuts intended to increase aggregate demand.

C) Tax cuts or spending hikes intended to increase aggregate demand.

D) Tax cuts or spending hikes intended to reduce aggregate demand.

Correct Answer

verified

Correct Answer

verified

True/False

Fiscal policy formation causes a delay in implementation even though a recession can usually be recognized within a few weeks after it begins.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy affects

A) The level of output only.

B) The mix of output only.

C) Both the level and the mix of output.

D) Interest rates only,and therefore does not affect the level or mix of output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jack has an MPC of 0.82 and Jill has an MPC of 0.78.Ceteris paribus,if the government transfers income from people who behave like Jack to people who behave like Jill,

A) It is not possible to predict what will happen to aggregate demand.

B) Aggregate demand will increase.

C) Aggregate demand will remain the same.

D) Aggregate demand will decrease.

Correct Answer

verified

Correct Answer

verified

True/False

When government spending increases,consumption also increases via the multiplier process.

Correct Answer

verified

Correct Answer

verified

True/False

Fiscal policy involves changes in government spending and taxes,but not regulation of prices or production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The recessionary GDP gap will differ from the AD shortfall when the

A) Multiplier effect raises spending.

B) Budget is balanced.

C) Aggregate supply curve slopes upward.

D) Multiplier effect lowers spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following fiscal policies cause a decrease in aggregate expenditures?

A) An increase in transfer payments and an increase in government spending.

B) An increase in transfer payments and a decrease in taxes.

C) A decrease in taxes and an increase in government spending.

D) An increase in taxes and a decrease in government spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the recessionary GDP gap is $500,then the proper fiscal stimulus when faced with an upward-sloping AS curve is to

A) Shift the AD curve rightward by $500.

B) Shift the AD curve rightward by more than $500.

C) Shift the AD curve leftward by $500.

D) Shift the AS curve rightward by less than $500.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 151

Related Exams