A) $186.00

B) $155.00

C) $57.66

D) $180.00

E) None of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Differential pay schedule is based on:

A) FICA

B) Different levels of performance

C) FUTA

D) Gross pay

E) None of these

Correct Answer

verified

Correct Answer

verified

True/False

A quarter is 13 weeks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sandi works for Elizabeth Arden Cosmetics and earns $500 per week salary plus 4% commission on sales over $2,000. If Sandi sold $2,733 last week, what was her salary?

A) $1,046.66

B) $2,743.00

C) $609.32

D) $906.32

E) None of these

Correct Answer

verified

Correct Answer

verified

True/False

Being paid biweekly is the same as being paid semimonthly.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lana Powell has cumulative earnings of $110,000 at the end of September. In the first week in October she earns $2,000. The amount deducted for Social Security and Medicare from her check is (assume Social Security rate of 6.2% on $110,100 and Medicare of 1.45%) :

A) $29.00

B) $35.20

C) $53.20

D) $92.00

E) None of these

Correct Answer

verified

Correct Answer

verified

True/False

The FICA tax now requires separate reporting for Social Security and Medicare.

Correct Answer

verified

Correct Answer

verified

True/False

The Fair Labor Standards Act entitles employees to time and a half over 36 1/2 hours.

Correct Answer

verified

Correct Answer

verified

True/False

The W-4 is used strictly to calculate Social Security and Medicare taxes.

Correct Answer

verified

Correct Answer

verified

Essay

Janice Tax, an accountant for Flee Corp., earned $102,700 from January to June. In July she earned $8,000. Assuming a FICA tax rate of 6.2% for Social Security on $110,100 and 1.45% for Medicare, (A) how much of this month's earnings are taxed for Social Security and Medicare? and (B) what is the amount of FICA tax for Social Security and Medicare?

Correct Answer

verified

Correct Answer

verified

True/False

Payroll registers cannot record cumulative earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jill Hartman earns $750 per week plus 3% of sales in excess of $6,500. If Jill sells $25,000 in the first week, her earnings are:

A) $945

B) $1,305

C) $1,500

D) $1,503

E) None of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The taxable earnings column of a payroll register records:

A) What wages will be taxed

B) The actual tax

C) The estimated tax

D) All of these

E) None of these

Correct Answer

verified

Correct Answer

verified

True/False

Differential pay means that there is one fixed rate per unit that is produced.

Correct Answer

verified

Correct Answer

verified

True/False

SUTA tax has no maximum amount that can be paid in a calendar year.

Correct Answer

verified

Correct Answer

verified

True/False

A variable commission scale means that for different levels of net sales there are different commission rates.

Correct Answer

verified

Correct Answer

verified

True/False

Net pay - deductions = gross pay.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

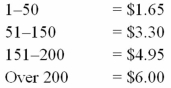

Mindy makes boots for Belleville Boot Factory. She is paid on the following differential pay scale:  What is Mindy's pay if she produced 192 boots for the week?

What is Mindy's pay if she produced 192 boots for the week?

A) $602.30

B) $702.90

C) $1,152.00

D) $620.30

E) None of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage method aids in calculating:

A) SUTA

B) FUTA

C) FICA

D) FIT

E) None of these

Correct Answer

verified

Correct Answer

verified

True/False

Gross pay = hours worked × rate per hour.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 62

Related Exams