Correct Answer

verified

Correct Answer

verified

True/False

Cost-volume-profit analysis can be presented in both graphically and equation form.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rouney Co.has budgeted that factory supervisors' salary will increase by 10%.If selling prices and all other cost relationships are held constant, next year's break-even point would:

A) decrease by 10%.

B) increase by 10%.

C) remain constant.

D) increase at a rate greater than 10%.

Correct Answer

verified

Correct Answer

verified

True/False

The break-even point (in units) is calculated by dividing the total estimated fixed costs by the net sales of a period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company operated at 82% of its capacity for the past year.Fixed costs during this time were $152,000, variable costs were 60% of sales, and sales were $790,000.Calculate the company's operating profit.

A) $97,000

B) $185,000

C) $56,000

D) $164,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of a variable cost?

A) Total variable cost remains constant with changes in the number of goods sold.

B) Unit variable cost decreases with an increase in production.

C) Unit variable cost remains constant with changes in production.

D) Total variable cost decreases with an increase in the number of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following activity bases would be the most appropriate for food costs of a hospital?

A) Number of cooks scheduled to work

B) Number of x-rays taken

C) Number of patients who are admitted in the hospital

D) Number of scheduled surgeries

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following conditions would cause the break-even point to increase?

A) Decrease in total fixed costs

B) Increase in unit selling price

C) Decrease in unit variable cost

D) Increase in unit variable cost

Correct Answer

verified

Correct Answer

verified

True/False

If the unit selling price is $50, the volume of sales is $450,000, sales at the break-even point amount to $375,000, and the maximum possible sales are $550,000, the margin of safety will be 2,000 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently, fixed costs are $540,000, the unit selling price is $95, and the unit variable cost is $60.What would be the break-even sales (in units) , if the unit selling price is increased by $10?

A) 5,294 units

B) 9,000 units

C) 12,857 units

D) 12,000 units

Correct Answer

verified

Correct Answer

verified

True/False

Only a single line, which represents the difference between total sales revenues and total costs, is plotted on the profit-volume graph.

Correct Answer

verified

Correct Answer

verified

True/False

Break-even analysis is a type of cost-volume-profit analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Co.manufactures pens.During the most productive month of the year, 3,650 pens were manufactured at a total cost of $84,550.During its slowest month, the company made 1,250 pens at a cost of $46,150.Calculate the total fixed cost using the high-low method of cost estimation.

A) $25,650

B) $28,300

C) $26,150

D) $27,800

Correct Answer

verified

Correct Answer

verified

True/False

If the volume of sales is $6,000,000 and sales at the break-even point amount to $4,800,000, the margin of safety will be 25%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate break-even sales (in units) when fixed cost is $216,000, unit selling price is $120, and unit variable cost is $60.

A) 4,100 units

B) 2,300 units

C) 3,400 units

D) 3,600 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is given for the maintenance department of Goldenrod Co.Calculate the variable costs per unit using the high-low method. ?

A) $0.17

B) $0.11

C) $0.25

D) $0.08

Correct Answer

verified

Correct Answer

verified

True/False

If direct materials cost per unit decreases, the amount of sales necessary to earn a desired amount of profit will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Foggy Co.has the following operating data for its manufacturing operations: ? The company has decided to increase the wages of hourly workers, which will increase the unit variable cost by 10%.Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%.If sales prices are held constant, the break-even point for Foggy Co.will:

A) increase by 400 units.

B) increase by 640 units.

C) decrease by 640 units.

D) increase by 800 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Omega Inc.is expecting a reduction of $25,000 in fixed costs of $725,000.What will be the change in break-even sales (in units) , if selling price per unit is $50 and the unit variable cost is $35?

A) 48,333 units

B) 46,667 units

C) 1,667 units

D) 2,500 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

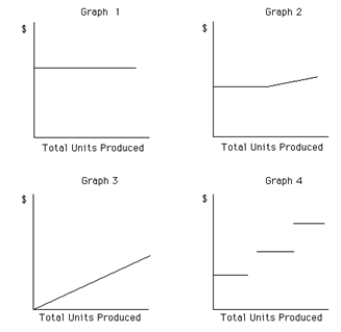

Which of the following graphs illustrates the behavior of a total fixed cost within the specified relevant range?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 129

Related Exams