A) a sale is made.

B) an account becomes bad and is written off.

C) management estimates the amount of uncollectibles.

D) a customer's account becomes past-due.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a note receivable is honored, Cash is debited for the note's

A) net realizable value.

B) maturity value.

C) gross realizable value.

D) face value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance of Allowance for Doubtful Accounts prior to making the adjusting entry to record estimated uncollectible accounts

A) is relevant when using the percentage of receivables basis.

B) is relevant when using the percentage of sales basis.

C) is relevant to both bases of adjusting for uncollectible accounts.

D) will never show a debit balance at this stage in the accounting cycle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2015, Warehouse 13 had net credit sales of $750,000. On January 1, 2015, Allowance for Doubtful Accounts had a credit balance of $16,000. During 2015, $29,000 of uncollectible accounts receivable were written off. Past experience indicates that the allowance should be 10% of the balance in receivables (percentage of receivable basis) . If the accounts receivable balance at December 31 was $150,000, what is the required adjustment to the Allowance for Doubtful Accounts at December 31, 2015?

A) $150,000

B) $29,000

C) $28,000

D) $31,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schwartzman Co., makes a credit card sale to a customer for $800. The credit card sale has a grace period of 30 days and then an interest charge of 1.5% per month is added to the balance. If the unpaid balance on the above sale is $640 at the end of the grace period, the interest charge is

A) $6.40.

B) $9.60.

C) $11.00.

D) $16.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deborah Company's account balances at December 31 for Accounts Receivable and Allowance for Doubtful Accounts were $2,100,000 and $50,000 (Cr.) , respectively. An aging of accounts receivable indicated that $180,000 are expected to become uncollectible. The amount of the adjusting entry for bad debts at December 31 is

A) $130,000.

B) $180,000.

C) $210,000.

D) $230,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following receivables would not be classified as an "other receivable"?

A) Advance to an employee

B) Refundable income tax

C) Notes receivable

D) Interest receivable

Correct Answer

verified

Correct Answer

verified

True/False

The maturity date of a 1-month note receivable dated June 30 is July 30.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bad Debt Expense is considered

A) an avoidable cost in doing business on a credit basis.

B) an internal control weakness.

C) a necessary risk of doing business on a credit basis.

D) avoidable unless there is a recession.

Correct Answer

verified

Correct Answer

verified

True/False

Allowance for Doubtful Accounts is debited under the direct write-off method when an account is determined to be uncollectible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

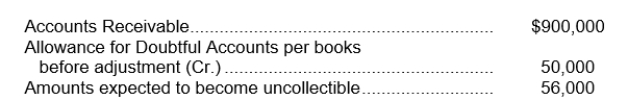

An analysis and aging of the accounts receivable of Hugh Company at December 31 revealed the following data:  The cash realizable value of the accounts receivable at December 31, after adjustment, is:

The cash realizable value of the accounts receivable at December 31, after adjustment, is:

A) $794,000.

B) $844,000.

C) $850,000.

D) $894,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kill Corporation's unadjusted trial balance includes the following balances (assume normal balances) :  Bad debts are estimated to be 6% of outstanding receivables. What amount of bad debt expense will the company record?

Bad debts are estimated to be 6% of outstanding receivables. What amount of bad debt expense will the company record?

A) $15,000

B) $36,000

C) $50,100

D) $51,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The receivable that is usually evidenced by a formal instrument of credit is a(n)

A) trade receivable.

B) note receivable.

C) accounts receivable.

D) income tax receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which receivables accounting and reporting issue is not essentially the same for IFRS and GAAP?

A) The use of allowance accounts and the allowance method.

B) How to record discounts.

C) How to record factoring.

D) All of these are essentially the same for IFRS and GAAP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $32,000. If the balance of the Allowance for Doubtful Accounts is $8,000 debit before adjustment, what is the amount of bad debt expense for that period?

A) $8,000

B) $24,000

C) $32,000

D) $40,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company fails to record estimated bad debts expense,

A) cash realizable value is understated.

B) expenses are understated.

C) revenues are understated.

D) receivables are understated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A promissory note

A) is not a formal credit instrument.

B) may be used to settle an accounts receivable.

C) has the party to whom the money is due as the maker.

D) cannot be factored to another party.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit balance in the Allowance for Doubtful Accounts

A) is the normal balance for that account.

B) indicates that actual bad debt write-offs have exceeded previous provisions for bad debts.

C) indicates that actual bad debt write-offs have been less than what was estimated.

D) cannot occur if the percentage of sales method of estimating bad debts is used.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Gervais Manufacturing Company report net sales of $500,000 and accounts receivable of $80,000 and $40,000 at the beginning and end of the year, respectively. What is the average collection period for accounts receivable in days?

A) 29.2 days

B) 36.5 days

C) 43.8 days

D) 57.9 days

Correct Answer

verified

Correct Answer

verified

True/False

The percentage of receivables basis of estimating expected uncollectible accounts emphasizes income statement relationships.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 167

Related Exams