Correct Answer

verified

Correct Answer

verified

Multiple Choice

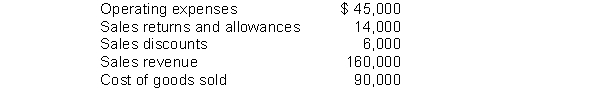

Financial information is presented below:  Gross profit would be

Gross profit would be

A) $90,000.

B) $70,000.

C) $60,000.

D) $66,000.

Correct Answer

verified

C

Correct Answer

verified

True/False

Sales Discounts is a contra revenue account to Sales Revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basic accounting entries for merchandising are

A) the same under GAAP and under IFRS.

B) required under GAAP but not under IFRS.

C) required under IFRS but not under GAAP.

D) required under IFRS with some differences as compared to GAAP.

Correct Answer

verified

Correct Answer

verified

True/False

Cost of Goods Sold is considered an expense of a merchandising firm.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is incorrect?

A) Periodic inventory systems provide better control over inventories than perpetual inventory systems.

B) Computers and electronic scanners allow more companies to use a perpetual inventory system.

C) Freight-in is debited to Inventory when a perpetual inventory system is used.

D) Regardless of the inventory system that is used, companies should take a physical inventory count.

Correct Answer

verified

Correct Answer

verified

Essay

Lovett Company provides this information for the month of November, 2014: sales on credit $140,000; cash sales $50,000; sales discount $2,000; and sales returns and allowances $8,000. Prepare the sales revenues section of the income statement based on this information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating expenses would include

A) interest expense.

B) income tax expense.

C) freight-out.

D) freight-out and interest.

Correct Answer

verified

Correct Answer

verified

True/False

Under a perpetual inventory system, the cost of goods sold is determined each time a sale occurs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adams Company is a retailer and uses a perpetual inventory system. Which statement is correct?

A) Returns of merchandise by Adams Company to a manufacturer are credited to Inventory.

B) Freight paid to get merchandise to Adams Company's store is debited to Freight Expense.

C) A return of merchandise by one of Adams Company's customers is credited to Inventory.

D) Discounts taken by Adams Company's customers are credited to Inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

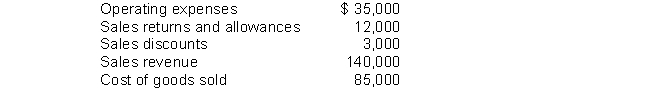

Financial information is presented below:  The amount of net sales on the income statement would be

The amount of net sales on the income statement would be

A) $128,000.

B) $125,000.

C) $140,000.

D) $137,000.

Correct Answer

verified

Correct Answer

verified

Essay

Horner Corporation reported net sales of $150,000, cost of goods sold of $96,000, operating expenses of $35,000, other expenses of $10,000, net income of $9,000. Calculate the following values. 1. Profit margin. 2. Gross profit rate.

Correct Answer

verified

Correct Answer

verified

Essay

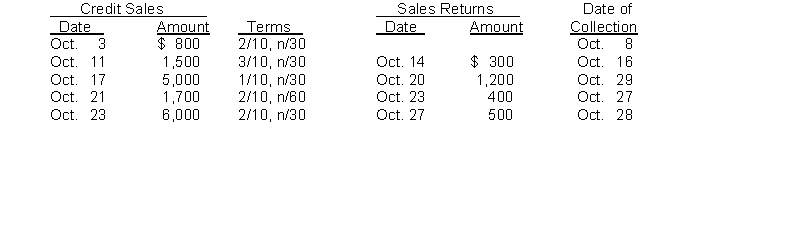

Norman Company completed the following transactions in October: Norman uses a perpetual inventory system.  Instructions

(a) Indicate the cash received for each collection. Show your calculations.

(b) Prepare the journal entry for the

(1) Oct. 17 sale. The merchandise sold had a cost of $3,000.

(2) Oct. 23 sales return. The merchandise returned had a cost of $200.

(3) Oct. 28 collection.

Instructions

(a) Indicate the cash received for each collection. Show your calculations.

(b) Prepare the journal entry for the

(1) Oct. 17 sale. The merchandise sold had a cost of $3,000.

(2) Oct. 23 sales return. The merchandise returned had a cost of $200.

(3) Oct. 28 collection.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary source of revenue for a wholesaler is

A) investment income.

B) service revenue.

C) the sale of merchandise.

D) the sale of plant assets the company owns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A credit sale of $700 is made on July 15, terms 2/10, net/30, on which a return of $50 is granted on July 18. What amount is received as payment in full on July 24?

A) $700

B) $637

C) $650 d $686

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is an advantage of using the multiple-step income statement?

A) It highlights the components of net income.

B) Gross profit is not a separate item.

C) It is easier to prepare than the single-step income statement.

D) Net income will be higher than net income computed using the single-step income statement.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Freight costs incurred by a seller on merchandise sold to customers will cause an increase

A) in the selling expenses of the buyer.

B) in operating expenses for the seller.

C) to the cost of goods sold of the seller.

D) to a contra-revenue account of the seller.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory becomes part of cost of goods sold when a company

A) pays for the inventory.

B) purchases the inventory.

C) sells the inventory.

D) receives payment from the customer.

Correct Answer

verified

Correct Answer

verified

True/False

The computer has increased greatly the use of the periodic inventory system.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

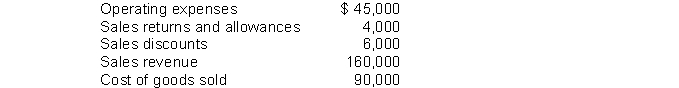

Financial information is presented below:  The amount of net sales on the income statement would be

The amount of net sales on the income statement would be

A) $154,000.

B) $150,000.

C) $160,000.

D) $156,000.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 261

Related Exams