Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement BEST illustrates social insurance?

A) collision insurance for automobiles

B) the Supplemental Nutrition Assistance Program (SNAP-formerly the food stamp program)

C) housing subsidies provided by the New York City Housing Authority

D) Social Security

Correct Answer

verified

Correct Answer

verified

Multiple Choice

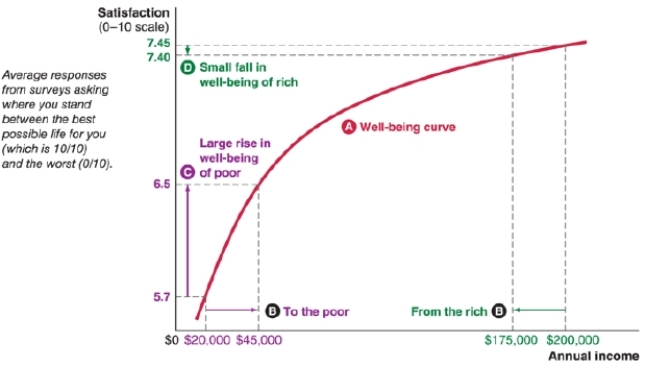

What relationship exists between income and well-being in the well-being curve found in the figure?

A) a negative relationship with increasing marginal gains in well-being as income rises

B) a negative relationship with decreasing marginal gains in well-being as income rises

C) a positive relationship with increasing marginal gains in well-being as income rises

D) a positive relationship with decreasing marginal gains in well-being as income rises

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Food stamps (now called the Supplemental Nutrition Assistance Program) is an example of:

A) a negative income tax.

B) an in-kind transfer.

C) a monetary benefit.

D) unemployment insurance.

Correct Answer

verified

Correct Answer

verified

Essay

There are many costs of the redistribution of income that reduce the efficiency gains of such programs. Summarize at least four costs associated with the redistribution of income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When there is a high level of intergenerational mobility among the poor in a nation:

A) most of the individuals who are poor remain poor.

B) most of the poor have incomes that are barely below the poverty line.

C) the age distribution among the poor is the same as the age distribution in the total population.

D) children of poor parents do not remain in poverty when they are adults.

Correct Answer

verified

Correct Answer

verified

Essay

How could a country have no absolute poverty and yet still have relative poverty?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Among the reasons for a social safety net is the desire to alleviate income inequality, reduce economic insecurity, and:

A) achieve economic equality for all households.

B) eliminate poverty.

C) provide access to health care.

D) increase economic efficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a social safety net?

A) It is the cash-assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B) It is government-provided financial funding to people to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C) It is the government assignment of jobs to individuals based on household need and employee education and skills.

D) It is a system where those with more income tend to pay a higher share of their income in taxes than those with lower incomes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which U.S. welfare program is an in-kind benefit that is NOT means-tested?

A) Medicaid

B) Medicare

C) food stamps

D) TANF (Temporary Assistance for Needy Families) program

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Social insurance programs do NOT:

A) set individual benefits based on past income.

B) obtain revenue through program-specific taxes and fees.

C) cover both rich and poor.

D) use a means test to qualify people for benefits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government programs that are "means-tested" require:

A) all citizens to be eligible for benefits regardless of income.

B) the program to verify that it accomplishes its purposes through its activities.

C) recipients to be examined to verify health status.

D) eligibility to be based on income and sometimes on wealth.

Correct Answer

verified

Correct Answer

verified

Essay

Explain why some economists favor the use of permanent income rather than annual income of a household when examining income inequality in a country.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Malia and Asi have a household income that is insufficient to pay for both food and shelter, with no funds available for other types of expenses. However, their household income is higher than 75% of the households in their developing nation. Malia feels that they are poor, and Asi feels that they are prosperous. Their feelings are consistent with which views of poverty?

A) Malia focuses on relative poverty, and Asi focuses on extreme poverty.

B) Malia focuses on extreme poverty, and Asi focuses on absolute poverty.

C) Malia focuses on absolute poverty, and Asi focuses on relative poverty.

D) Malia focuses on relative poverty, and Asi focuses on absolute poverty.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a government program is not means-tested, it:

A) provides benefits for everyone, regardless of their incomes.

B) helps people who have low incomes.

C) provides benefits only to households that earn less than the mean household income in a given year.

D) provides only in-kind benefits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2017, _____ of the U.S. population lived in poverty.

A) approximately 13%

B) 20% to 24%

C) 25% to 29%

D) more than 30%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some safety net programs provide specific goods rather than income or tax breaks. This type of program benefit is known as:

A) an in-kind transfer.

B) an income-substitute transfer.

C) a product-specific transfer.

D) an alternative need transfer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a means-tested social safety net program in the United States?

A) Medicaid

B) Social Security

C) housing assistance

D) earned income tax credit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Temporary Assistance for Needy Families provides a _____.

A) non-means-tested monetary benefit

B) non-means-tested in-kind benefit

C) means-tested monetary benefit

D) means-tested in-kind benefit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government-provided financial funding to households to compensate for bad outcomes such as unemployment, illness, disability, or outliving your savings is known as a:

A) progressive tax system.

B) social safety net.

C) social insurance system.

D) disaster relief program.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 190

Related Exams