A) handled retroactively in accordance with the guidance related to changes in accounting principles.

B) considered, but it should only be recorded in the accounts if it reduces a deferred tax liability or increases a deferred tax asset.

C) reported as an adjustment to tax expense in the period of change.

D) applied to all temporary or permanent differences that arise prior to the date of the enactment of the tax rate change, but not subsequent to the date of the change.

Correct Answer

verified

Correct Answer

verified

True/False

A reversing difference occurs when a temporary difference that originated in prior periods is eliminated and the related tax effect is removed from the deferred tax account.

Correct Answer

verified

Correct Answer

verified

True/False

In computing deferred income taxes, a new tax rate should be used if (a) it is probable that a future tax rate change will occur, and (b) the rate is reasonably estimable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

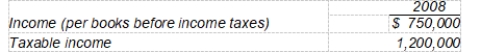

Dwyer Company reported the following results for the year ended December 31, 2008, its first year of operations:

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2009. What should Dwyer record as a net deferred tax asset or liability for the year ended December 31, 2008, assuming that the enacted tax rates in effect are 40% in 2008 and 35% in 2009?

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2009. What should Dwyer record as a net deferred tax asset or liability for the year ended December 31, 2008, assuming that the enacted tax rates in effect are 40% in 2008 and 35% in 2009?

A) $180,000 deferred tax liability

B) $157,500 deferred tax asset

C) $180,000 deferred tax asset

D) $157,500 deferred tax liability

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nolan Company sells its product on an installment basis, earning a $450 pretax gross profit on each installment sale. For accounting purposes the entire $450 is recognized in the year of sale, but for income tax purposes the installment method of accounting is used. Assume Nolan makes one sale in 2007, another sale in 2008, and a third sale in 2009. In each case, one-third of the gross sales price is collected in the year of sale, one-third in the next year, and the final installment in the third year. If the tax rate is 50%, what amount of deferred tax liability should Nolan Company show on its December 31, 2009 balance sheet?

A) $150

B) $225

C) $300

D) $450

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fesmire Co. had a deferred tax liability balance due to a temporary difference at the beginning of 2007 related to $200,000 of excess depreciation. In December of 2007, a new income tax act is signed into law that raises the corporate rate from 35% to 40%, effective January 1, 2009. If taxable amounts related to the temporary difference are scheduled to be reversed by $100,000 for both 2008 and 2009, Fesmire should increase or decrease deferred tax liability by what amount?

A) Decrease by $10,000

B) Decrease by $5,000

C) Increase by $5,000

D) Increase by $10,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McGee Company deducts insurance expense of $84,000 for tax purposes in 2008, but the expense is not yet recognized for accounting purposes. In 2009, 2010, and 2011, no insurance expense will be deducted for tax purposes, but $28,000 of insurance expense will be reported for accounting purposes in each of these years. McGee Company has a tax rate of 40% and income taxes payable of $72,000 at the end of 2008. There were no deferred taxes at the beginning of 2008. -Assuming that income tax payable for 2009 is $96,000, the income tax expense for 2009 would be what amount?

A) $129,600

B) $107,200

C) $96,000

D) $84,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major distinction between temporary and permanent differences is

A) permanent differences are not representative of acceptable accounting practice.

B) temporary differences occur frequently, whereas permanent differences occur only once.

C) once an item is determined to be a temporary difference, it maintains that status; however, a permanent difference can change in status with the passage of time.

D) temporary differences reverse themselves in subsequent accounting periods, whereas permanent differences do not reverse.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a permanent difference that is recognized for tax purposes but not for financial reporting purposes?

A) The deduction for dividends received from U.S. corporations.

B) Interest received on state and municipal bonds.

C) Compensation expense associated with certain employee stock options.

D) A litigation accrual.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of accelerated depreciation for tax purposes and straight-line depreciation for accounting purposes results in

A) a larger amount of depreciation expense shown on the tax return than on the income statement, over the asset's useful life.

B) the asset being fully depreciated for tax purposes in half the time it takes to become fully depreciated for accounting purposes.

C) a larger amount of depreciation expense shown on the income statement than on the tax return in the last year of the asset's useful life.

D) a loss on the sale of the asset in question if it is sold for its book value before its useful life expires.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bennington Corporation began operations in 2004. There have been no permanent or temporary differences to account for since the inception of the business. The following data are available:

In 2008, Bennington had an operating loss of $930,000. What amount of income tax benefits should be reported on the 2008 income statement due to this loss?

In 2008, Bennington had an operating loss of $930,000. What amount of income tax benefits should be reported on the 2008 income statement due to this loss?

A) $409,500

B) $373,500

C) $372,000

D) $279,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

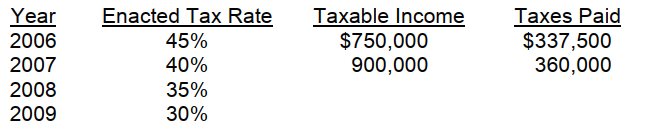

Karr, Inc. uses the accrual method of accounting for financial reporting purposes and appropriately uses the installment method of accounting for income tax purposes. Installment income of $900,000 will be collected in the following years when the enacted tax rates are:  The installment income is Karr's only temporary difference. What amount should be included in the deferred income tax liability in Karr's December 31, 2007 balance sheet?

The installment income is Karr's only temporary difference. What amount should be included in the deferred income tax liability in Karr's December 31, 2007 balance sheet?

A) $225,000

B) $256,500

C) $283,500

D) $315,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tyler Company made the following journal entry in late 2008 for rent on property it leases to Danford Corporation.

The payment represents rent for the years 2009 and 2010, the period covered by the lease. Tyler Company is a cash basis taxpayer. Tyler has income tax payable of $92,000 at the end of 2008, and its tax rate is 35%

-Assuming the taxes payable at the end of 2009 is $102,000, what amount of income tax expense would Tyler Company record for 2009?

The payment represents rent for the years 2009 and 2010, the period covered by the lease. Tyler Company is a cash basis taxpayer. Tyler has income tax payable of $92,000 at the end of 2008, and its tax rate is 35%

-Assuming the taxes payable at the end of 2009 is $102,000, what amount of income tax expense would Tyler Company record for 2009?

A) $81,000

B) $91,500

C) $112,500

D) $123,000

Correct Answer

verified

Correct Answer

verified

True/False

In general, the tax benefits of loss carryforwards should not be recognized in the loss year when the benefits arise, but rather in the year they are realized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

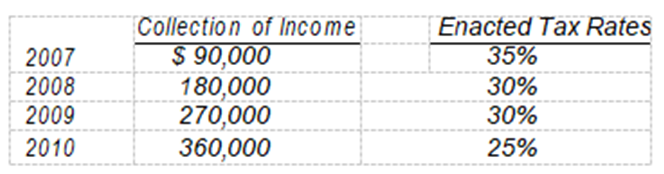

Hefner Co. at the end of 2008, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,250,000 will be deductible in 2010 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent. The income tax rate is 30% for all years.

-The income tax expense is

The estimated litigation expense of $1,250,000 will be deductible in 2010 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent. The income tax rate is 30% for all years.

-The income tax expense is

A) $150,000.

B) $225,000.

C) $250,000.

D) $500,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hefner Co. at the end of 2008, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,250,000 will be deductible in 2010 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax liability-current to be recognized is

The estimated litigation expense of $1,250,000 will be deductible in 2010 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax liability-current to be recognized is

A) $75,000.

B) $225,000.

C) $150,000.

D) $300,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

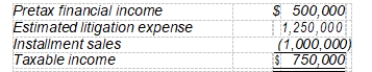

Frizell Co. at the end of 2007, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2008 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years. The income tax rate is 30% for all years.

-Income tax payable is

The estimated litigation expense of $1,000,000 will be deductible in 2008 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years. The income tax rate is 30% for all years.

-Income tax payable is

A) $0.

B) $75,000.

C) $150,000.

D) $225,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eddy Corp.'s 2008 income statement showed pretax accounting income of $750,000. To compute the federal income tax liability, the following 2008 data are provided:  What amount of current federal income tax liability should be included in Eddy's December 31, 2008 balance sheet?

What amount of current federal income tax liability should be included in Eddy's December 31, 2008 balance sheet?

A) $48,000

B) $66,000

C) $75,000

D) $198,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Meyers Co. had a deferred tax liability balance due to a temporary difference at the beginning of 2007 related to $600,000 of excess depreciation. In December of 2007, a new income tax act is signed into law that lowers the corporate rate from 40% to 35%, effective January 1, 2009. If taxable amounts related to the temporary difference are scheduled to be reversed by $300,000 for both 2008 and 2009, Meyers should increase or decrease deferred tax liability by what amount?

A) Decrease by $30,000

B) Decrease by $15,000

C) Increase by $15,000

D) Increase by $30,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mast, Inc. reports a taxable and financial loss of $650,000 for 2009. Its pretax financial income for the last two years was as follows:

The amount that Mast, Inc. reports as a net loss for financial reporting purposes in 2009, assuming that it uses the carryback provisions, and that the tax rate is 30% for all periods affected, is

The amount that Mast, Inc. reports as a net loss for financial reporting purposes in 2009, assuming that it uses the carryback provisions, and that the tax rate is 30% for all periods affected, is

A) $650,000 loss.

B) $0.

C) $195,000 loss.

D) $455,000 loss.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 69

Related Exams