A) $20/£

B) €0.85/$

C) ¥100/€

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A forward contract to deliver British pounds for U.S. dollars could be described either as ________ or ________.

A) buying dollars forward; buying pounds forward

B) selling pounds forward; selling dollars forward

C) selling pounds forward; buying dollars forward

D) selling dollars forward; buying pounds forward

Correct Answer

verified

Correct Answer

verified

True/False

Dealers in the foreign exchange departments of large international banks often function as "market makers." Such dealers stand willing at all times to buy and sell those currencies in which they specialize and thus maintain an "inventory" position in those currencies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The greatest volume of daily foreign exchange transactions are:

A) spot transactions.

B) forward transactions.

C) swap transactions.

D) This question is inappropriate because the volume of transactions are approximately equal across the three categories above.

Correct Answer

verified

Correct Answer

verified

True/False

The European and American terms for foreign currency exchange are square roots of one another.

Correct Answer

verified

Correct Answer

verified

True/False

In general, NDF markets normally develop for country currencies having large cross-border capital movements, but still subject to convertibility restrictions.

Correct Answer

verified

Correct Answer

verified

True/False

A confusing "quirk" of international exchange rates occurs when calculating the percentage change in spot rates from one period to another. The percent change in the spot rate from one period to another when quoted using foreign currency terms is always greater than the percent changes quoted when using home currency terms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is NOT one of the three categories reported for foreign exchange.

A) Spot transactions

B) Swap transactions

C) Strip transactions

D) Futures transactions

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ is a derivative forward contract that was created in the 1990s. It has the same characteristics and documentation requirements as traditional forward contracts except that they are only settled in U.S. dollars and the foreign currency involved in the transaction is not delivered.

A) nondeliverable forward

B) dollar only forward

C) virtual forward

D) internet forward

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT true regarding the market for foreign exchange?

A) The market provides the physical and institutional structure through which the money of one country is exchanged for another.

B) The rate of exchange is determined in the market.

C) Foreign exchange transactions are physically completed in the foreign exchange market.

D) All of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

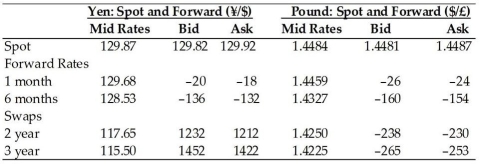

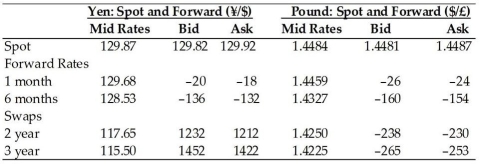

TABLE 5.1

Use the table to answer following question(s) .

-Refer to Table 5.1. The one-month forward bid price for dollars as denominated in Japanese yen is:

Use the table to answer following question(s) .

-Refer to Table 5.1. The one-month forward bid price for dollars as denominated in Japanese yen is:

A) -¥20.

B) -¥18.

C) ¥129.74/$.

D) ¥129.62/$.

Correct Answer

verified

Correct Answer

verified

True/False

Since the global financial crisis of 2008-2009, the Chinese renminbi (yuan) has become the most widely traded currency with the U.S. dollar surpassing the euro, yen, and pound as dollar trading pairs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ________ transaction in the foreign exchange market requires delivery of foreign exchange at some future date.

A) spot

B) forward

C) swap

D) currency

Correct Answer

verified

Correct Answer

verified

True/False

Swap and forward transactions account for an insignificant portion of the foreign exchange market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TABLE 5.1

Use the table to answer following question(s) .

-Refer to Table 5.1. According to the information provided in the table, the 6-month yen is selling at a forward ________ of approximately ________ per annum. (Use the mid rates to make your calculations.)

Use the table to answer following question(s) .

-Refer to Table 5.1. According to the information provided in the table, the 6-month yen is selling at a forward ________ of approximately ________ per annum. (Use the mid rates to make your calculations.)

A) discount; 2.09%

B) discount; 2.06%

C) premium; 2.09%

D) premium; 2.06%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ seek to profit from trading in the market itself rather than having the foreign exchange transaction being incidental to the execution of a commercial or investment transaction.

A) Speculators and arbitrageurs

B) Foreign exchange brokers

C) Central banks

D) Treasuries

Correct Answer

verified

Correct Answer

verified

True/False

Business firms in countries with exchange controls, for example, China (mainland), often must surrender foreign exchange earned from exports to the central bank at the daily fixing price.

Correct Answer

verified

Correct Answer

verified

True/False

Because the market for foreign exchange is worldwide, the volume of foreign exchange currency transactions is level throughout the 24-hour day.

Correct Answer

verified

Correct Answer

verified

True/False

For individuals and firms involved in the import and export of goods and services, using the foreign exchange market is necessary, but incidental, to their underlying commercial or investment purpose.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A/An ________ is an agreement between a buyer and seller that a fixed amount of one currency will be delivered at a specified rate for some other currency.

A) Eurodollar transaction

B) import/export exchange

C) foreign exchange transaction

D) interbank market transaction

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 69

Related Exams