A) the supply of loanable funds would shift right and investment would increase.

B) the supply of loanable funds would shift left and investment would decrease.

C) the demand for loanable funds would shift right and investment would increase.

D) the demand for loanable funds would shift left and investment would decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose people expect inflation to be 3 percent during the next several years. When the real interest rate is 5 percent, the money, or nominal interest rate, will be

A) 1 percent.

B) 4 percent.

C) 7 percent.

D) 8 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market for labor services is included in the

A) loanable funds market.

B) goods and services market.

C) resource market.

D) financial market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The aggregate demand curve indicates the relationship between

A) the real wage rate and the quality of resources demanded by producers of goods and services.

B) the interest rate and the amount of loanable funds demanded by borrowers.

C) the natural rate of unemployment and the demand for goods and services when the economy is in long-run equilibrium.

D) the general price level and the aggregate quantity of goods and services demanded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The change in the aggregate quantity of goods and services demanded in the U.S. is based on the logic that as the price level falls,

A) real wealth falls, interest rates rise, and net exports fall.

B) real wealth falls, interest rates rise, and net exports rise.

C) real wealth rises, interest rates fall, and net exports fall.

D) real wealth rises, interest rates fall, and net exports rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net exports are positive, then

A) net capital outflow is positive (indicating an inflow of capital) , so foreign assets bought by Americans are greater than American assets bought by foreigners.

B) net capital outflow is positive (indicating an inflow of capital) , so American assets bought by foreigners are greater than foreign assets bought by Americans.

C) net capital outflow is negative (indicating an outflow of capital) , so foreign assets bought by Americans are greater than American assets bought by foreigners.

D) net capital outflow is negative (indicating an outflow of capital) , so American assets bought by foreigners are greater than foreign assets bought by Americans.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following markets coordinates transactions with foreigners that involve the exchange of currency?

A) the resource market

B) the stock market

C) the foreign exchange market

D) the loanable funds market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal, which of the following is true?

A) A reduction in prices will increase the real wealth of those holding a fixed quantity of money.

B) A reduction in prices will lead to a decline in net exports.

C) A reduction in prices will increase the scarcity of money, raise the real interest rate, and, thereby, encourage investment and consumption.

D) A reduction in prices will increase profit margins and, thereby, stimulate additional investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because many resource prices are set by long-term contracts, in the short run

A) costs will increase by more than product prices when demand increases.

B) costs will decrease when the demand for products increases.

C) costs will increase by less than product prices when demand increases.

D) costs will decrease by more than product prices when demand decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gladys agrees to lend Kay $1,000 for one year at a nominal rate of interest of 5 percent. At the end of the year prices have actually risen by 7 percent. Gladys earned a real rate of return of

A) Negative 2%.

B) 2%.

C) 5%.

D) 7%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a correct statement?

A) Fiscal policy is the use of tax and spending policies by Congress and the president.

B) Fiscal policy involves the control of the money supply by the Federal Reserve Bank.

C) Monetary policy involves the control of the money supply by Congress and the president.

D) Monetary policy is the use of tax and spending policies by the Federal Reserve Bank.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money rate of interest will be less than the real rate of interest when decision makers anticipate

A) stable prices in the future.

B) falling prices in the future.

C) inflation in the future.

D) that the money rate of interest will decline.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

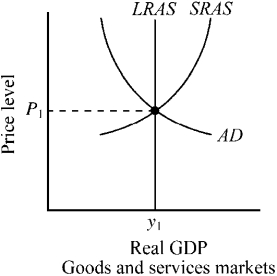

Use the figure below to answer the following question(s) .

Figure 9-2

-Which of the following is true for the economy depicted in Figure 9-2?

-Which of the following is true for the economy depicted in Figure 9-2?

A) Potential output equals Y₁.

B) It would be impossible for this economy to achieve an output greater than Y₁.

C) When output Y₁ is achieved, the actual rate of unemployment will exceed the natural rate of unemployment.

D) When output Y₁ is achieved, the actual rate of unemployment will be less than the natural rate of unemployment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose, over the past year, the real interest rate was 3 percent and the inflation rate was 1 percent.

A) The dollar value of savings increased at 2 percent, and the value of savings measured in goods increased at 3 percent.

B) The dollar value of savings increased at 1 percent, and the value of savings measured in goods increased at 2 percent.

C) The dollar value of savings increased at 3 percent, and the value of savings measured in goods increased at 1 percent.

D) The dollar value of savings increased at 4 percent, and the value of savings measured in goods increased at 3 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, a decrease in the price level makes the dollars people hold worth

A) more, so they are willing to spend more.

B) more, so they are willing to spend less.

C) less, so they are willing to spend more.

D) less, so they are willing to spend less.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The aggregate demand curve slopes downward indicating that

A) an increase in the general price level will reduce the aggregate quantity of goods and services demanded.

B) an increase in the general price level will increase the aggregate quantity of goods and services demanded.

C) a change in the interest rate will alter the aggregate quantity of goods and services demanded.

D) consumers substitute between domestic-made and foreign-made goods as their relative prices change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price level in the current period is higher than what buyers and sellers anticipated,

A) profit margins will be unattractive and firms will expand output.

B) profit margins will be unattractive and firms will reduce output.

C) profit margins will be attractive and firms will expand output.

D) profit margins will be attractive and firms will reduce output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the value of a nation's imports exceeds exports, the nation has a

A) government budget deficit.

B) trade surplus.

C) trade deficit.

D) negative net capital flow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the real interest rate in the domestic loanable funds market increases,

A) the cost of purchasing goods and services during the current period will decline.

B) the net inflow of capital from abroad will increase.

C) the inflationary premium will rise, and the money rate of interest will decline.

D) the inflationary premium will fall, and the money rate of interest will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If equilibrium is present in the foreign exchange market and a nation is experiencing a trade deficit,

A) the nation must be experiencing a net capital inflow.

B) the nation must be experiencing a net capital outflow.

C) the nation's inflation rate must increase.

D) the nation's interest rate must increase.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 237

Related Exams