A) 13%

B) 10%

C) 4%

D) 8%

E) −2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) If beta doubles,the required return doubles.

B) If a stock has a negative beta,its required return is negative.

C) Higher beta stocks have more company-specific risk,but do not necessarily have more market risk.

D) If a portfolio's beta increases from 1.2 to 1.5,its required rate of return will increase by an amount equal to its market risk premium.

E) If two stocks have the same standard deviation and the correlation coefficient between the returns of two stocks equals zero,an equally weighted portfolio of the two stocks will have a standard deviation lower than that of the individual stocks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

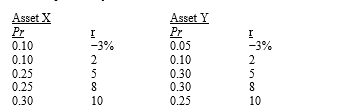

Assume that a new law is passed which restricts investors to holding only one asset.A risk-averse investor is considering two possible assets as the asset to be held in isolation.The assets' possible returns and related probabilities (i.e. ,the probability distributions) are as follows:  Which asset should be preferred?

Which asset should be preferred?

A) Asset X,since its expected return is higher.

B) Asset Y,since its beta is probably lower.

C) Either one,since the expected returns are the same.

D) Asset X,since its standard deviation is lower.

E) Asset Y,since its coefficient of variation is lower and its expected return is higher.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Motor Homes Inc.(MHI) is presently in a stage of abnormally high growth because of a surge in the demand for motor homes.The company expects earnings and dividends to grow at a rate of 20 percent for the next 4 years,after which time there will be no growth (g = 0) in earnings and dividends.The company's last dividend was $1.50.MHI has a beta of 1.6,the return on the market is currently 12.75 percent,and the risk-free rate is 4 percent.What should be the current price per share of common stock?

A) $15.17

B) $17.28

C) $22.21

D) $19.10

E) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Portfolio diversification reduces the variability of the returns on the individual stocks held in the portfolio.

B) If an investor buys enough stocks,he or she can,through diversification,eliminate virtually all of the nonmarket (or company-specific) risk inherent in owning stocks.Indeed,if the portfolio contained all publicly traded stocks,it would be riskless.

C) The required return on a firm's common stock is determined by its systematic (or market) risk.If the systematic risk is known,and if that risk is expected to remain constant,then no other information is required to specify the firm's required return.

D) A security's beta measures its nondiversifiable (systematic,or market) risk relative to that of an average stock.

E) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are an investor in common stock,and you currently hold a well-diversified portfolio which has an expected return of 12 percent,a beta of 1.2,and a total value of $9,000.You plan to increase your portfolio by buying 100 shares of AT&E at $10 a share.AT&E has an expected return of 20 percent with a beta of 2.0.What will be the expected return and the beta of your portfolio after you purchase the new stock?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

E) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

____ is the appropriate measure for stand-alone risk and ____ is the appropriate measure of risk when adding an asset to a diversified portfolio.

A) beta;variance

B) beta;standard deviation

C) standard deviation;beta

D) standard deviation;variance

Correct Answer

verified

Correct Answer

verified

True/False

If I know for sure that the market will have a positive return over the next year,to maximize my rate of return,I should increase the beta of my portfolio.

Correct Answer

verified

Correct Answer

verified

True/False

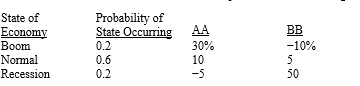

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB.

We can conclude from the above information that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a diversified portfolio consisting of a $5,000 investment in each of 20 different common stocks.The portfolio beta is equal to 1.15.You have decided to sell one of your stocks,a lead mining stock whose β = 1.0,for $5,000 net and to use the proceeds to buy $5,000 of stock in a steel company whose β = 2.0.What will be the new beta of the portfolio?

A) 1.12

B) 1.20

C) 1.22

D) 1.10

E) 1.15

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 1.5 and Stock B has a beta of 0.5.Which of the following statements must be true about these securities? (Assume the market is in equilibrium. )

A) When held in isolation,Stock A has greater risk than Stock B.

B) Stock B would be a more desirable addition to a portfolio than Stock A.

C) Stock A would be a more desirable addition to a portfolio than Stock B.

D) The expected return on Stock A will be greater than that on Stock B.

E) The expected return on Stock B will be greater than that on Stock A.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) An increase in expected inflation could be expected to increase the required return on a riskless asset and on an average stock by the same amount,other things held constant.

B) A graph of the SML would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

C) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio,the portfolio's expected return would be a weighted average of the stocks' expected returns,but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

D) If investors became more averse to risk,then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

E) The CAPM has been thoroughly tested,and the theory has been confirmed beyond any reasonable doubt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the risk-free rate is 7 percent,the expected return on the market is 10 percent,and the expected return on Security J is 13 percent,what is the beta of Security J?

A) 1.0

B) 1.5

C) 2.0

D) 2.5

E) 3.0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the following information,determine which beta coefficient for Stock A is consistent with equilibrium: rs = 11.3%;rRF = 5%;rM = 10%

A) 0.86

B) 1.26

C) 1.10

D) 0.80

E) 1.35

Correct Answer

verified

Correct Answer

verified

True/False

When comparing two different stocks with the same expected return but different standard deviations,you must compute the coefficient of variation to determine which stock is preferred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The beta of any portfolio can be computed as the

A) slope of the security market line

B) sum of the betas for each asset held in the portfolio divided by the number of assets in the portfolio.

C) the standard deviation of the expected returns of the portfolio minus the risk-free rate.

D) weighted average of the betas for each asset held in the portfolio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) The coefficient of variation is a better measure of risk than the standard deviation if the expected returns of the securities being compared differ significantly.

B) Managers cannot act in the best interests of their shareholders unless they know their shareholders' average time preference for receiving their money and what risks a typical shareholder is prepared to assume.

C) Companies should deliberately increase their risk relative to the market only if the actions that increase the risk also increase the expected rate of return on the firm's assets by enough to completely compensate for the higher risk.

D) If the expected rate of return for a particular investment,as seen by the marginal investor,exceeds its required rate of return,we should soon observe an increase in demand for the investment,and the price will likely increase until a price is established that equates the expected return with the required return.

E) All of the above statements are correct.

Correct Answer

verified

Correct Answer

verified

True/False

The risk and return characteristics of an investment should not be evaluated in isolation;instead,the risk return and return of an individual security should be analyzed in terms of how that security affects the risk and return of the portfolio in which it is held.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk averse investors require ____ rates of return for investments with ____ risk.

A) higher;lower

B) lower;higher

C) lower;lower

D) higher;higher

E) both c and d are correct

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carlson Products,a constant growth company,has a current market (and equilibrium) stock price of $20.00.Carlson's next dividend,  ,is forecasted to be $2.00,and Carlson is growing at an annual rate of 6 percent.Carlson has a beta coefficient of 1.2,and the required rate of return on the market is 15 percent.As Carlson's financial manager,you have access to insider information concerning a switch in product lines which would not change the growth rate,but would cut Carlson's beta coefficient in half.If you buy the stock at the current market price,what is your expected percentage capital gain?

,is forecasted to be $2.00,and Carlson is growing at an annual rate of 6 percent.Carlson has a beta coefficient of 1.2,and the required rate of return on the market is 15 percent.As Carlson's financial manager,you have access to insider information concerning a switch in product lines which would not change the growth rate,but would cut Carlson's beta coefficient in half.If you buy the stock at the current market price,what is your expected percentage capital gain?

A) 23%

B) 33%

C) 43%

D) 53%

E) There would be a capital loss.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 104

Related Exams