Correct Answer

verified

Correct Answer

verified

Multiple Choice

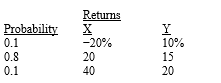

Here are the expected returns on two stocks:  If you form a 50−50 portfolio of the two stocks,what is the portfolio's standard deviation?

If you form a 50−50 portfolio of the two stocks,what is the portfolio's standard deviation?

A) 8.1%

B) 10.5%

C) 13.4%

D) 16.5%

E) 20.0%

Correct Answer

verified

Correct Answer

verified

True/False

A firm cannot change its beta through any managerial decision because betas are completely market determined.

Correct Answer

verified

Correct Answer

verified

True/False

If we compare the historical returns for two stocks from different industries in the United States,it is very likely that the correlation coefficient between these two stock returns is zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Risk refers to the chance that some unfavorable event will occur,and a probability distribution is completely described by a listing of the likelihood of unfavorable events.

B) Portfolio diversification reduces the variability of returns on an individual stock.

C) When company specific risk has been diversified,the inherent risk that remains is market risk which is constant for all securities in the market.

D) A stock with a beta of −1.0 has zero systematic (or market) risk.

E) The SML relates required returns to firms' systematic (or market) risk.The slope and intercept of this line cannot be controlled by the financial manager.

Correct Answer

verified

Correct Answer

verified

True/False

While the portfolio return is a weighted average of realized security returns,portfolio risk is not necessarily a weighted average of the standard deviations of the securities in the portfolio.It is this aspect of portfolios that allows investors to combine stocks and actually reduce the riskiness of a portfolio.

Correct Answer

verified

Correct Answer

verified

True/False

When a firm makes bad managerial judgments or has unforeseen negative events happen to it that affect its returns,these random events are unpredictable and therefore cannot be diversified away by the investor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For markets to be in equilibrium,that is,for there to be no strong pressure for prices to depart from their current levels,

A) The expected rate of return must be equal to the required rate of return; that is, ![]() .

.

B) The past realized rate of return must be equal to the expected rate of return; that is: ![]() .

.

C) The required rate of return must equal the realized rate of return; that is, ![]() .

.

D) All three of the above statements must hold for equilibrium to exist; that is, ![]()

E) None of the above statements is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) The required return on a firm's common stock is determined by the firm's systematic (or market) risk.If its systematic risk is known,and if it is expected to remain constant,the analyst has sufficient information to specify the firm's required return.

B) A security's beta measures its nondiversifiable (systematic,or market) risk relative to that of most other securities.

C) If the returns of two firms are negatively correlated,one of them must have a negative beta.

D) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only one stock.

E) Statements b and c are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) If you add enough randomly selected stocks to a portfolio,you can completely eliminate all the market risk from the portfolio.

B) If you formed a portfolio which included a large number of low beta stocks (stocks with betas less than 1.0 but greater than −1.0) ,the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio,so the portfolio would have a relatively low degree of risk.

C) If you were restricted to investing in publicly traded common stocks,yet you wanted to minimize the riskiness of your portfolio as measured by its beta,then,according to the CAPM theory,you should invest some of your money in each stock in the market,i.e. ,if there were 10,000 traded stocks in the world,the least risky portfolio would include some shares in each of them.

D) Company-specific (or unsystematic) risk can be eliminated by forming a large portfolio,but normally even highly diversified portfolios are subject to market (or systematic) risk.

E) Statements b and d are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When combining many assets into a portfolio the correlation between the variables has a(n) ____ impact on the overall risk of the portfolio than the overall risk of each asset.

A) larger

B) equal

C) smaller

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a portfolio of three different stocks,which of the following could not be true?

A) The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation.

B) The riskiness of the portfolio is greater than the riskiness of one or two of the stocks.

C) The beta of the portfolio is less than the beta of each of the individual stocks.

D) The beta of the portfolio is greater than the beta of one or two of the individual stock's betas.

E) None of the above (i.e. ,they all could be true,but not necessarily at the same time) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are managing a portfolio of 10 stocks which are held in equal amounts.The current beta of the portfolio is 1.64,and the beta of Stock A is 2.0.If Stock A is sold,what would the beta of the replacement stock have to be to produce a new portfolio beta of 1.55?

A) 1.10

B) 1.00

C) 0.90

D) 0.75

E) 0.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If the returns on a stock could vary widely,and its standard deviation is large,then the stock will necessarily have a large beta coefficient.

B) A stock that is more highly positively correlated with "The Market" than most stocks would not necessarily have a beta coefficient that is greater than 1.0.

C) A stock's standard deviation of returns is a measure of the stock's "stand-alone" risk,while its coefficient of variation measures its risk if the stock is held in a portfolio.

D) A portfolio that contained 100 low-beta stocks would be riskier than a portfolio containing 100 high-beta stocks.

E) Negative betas cannot exist;if you calculate one,you made an error.

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a given stock against those of the market,and if you found that the slope of the regression line was negative,the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor,assuming that the observed relationship is expected to continue into the future.

Correct Answer

verified

Correct Answer

verified

True/False

When comparing two stocks with the same standard deviation but the different expected returns,you must compute the coefficient of variation to determine which stock is preferred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given the following data: (1) The risk-free rate is 5 percent. (2) The required return on the market is 8 percent. (3) The expected growth rate for the firm is 4 percent. (4) The last dividend paid was $0.80 per share. (5) Beta is 1.3. Now assume the following changes occur: (1) The inflation premium drops by 1 percent. (2) An increased degree of risk aversion causes the required return on the market to go to 10 percent after adjusting for the changed inflation premium. (3) The expected growth rate increases to 6 percent. (4) Beta rises to 1.5. What will be the change in price per share,assuming the stock was in equilibrium before the changes?

A) +$12.11

B) −$4.87

C) +$6.28

D) −$16.97

E) +$2.78

Correct Answer

verified

Correct Answer

verified

True/False

Because the market return represents the return on an average stock,that return carries risk with it.As a result,there exists a market risk premium which is the amount over and above the risk-free rate that is required to compensate an investor for assuming an average amount of risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Company has been growing at a 10% rate,and it just paid a dividend of D0 = $3.00.Due to a new product,ABC expects to achieve a dramatic increase in its short-run growth rate,to 20 percent annually for the next 2 years.After this time,growth is expected to return to the long-run constant rate of 10 percent.The company's beta is 2.0,the required return on an average stock is 11 percent,and the risk-free rate is 7 percent.What should the dividend yield (  /P0) be today?

/P0) be today?

A) 3.93%

B) 4.60%

C) 10.00%

D) 7.54%

E) 2.33%

Correct Answer

verified

Correct Answer

verified

True/False

The Y-axis intercept of the SML indicates the return on the individual asset when the realized return on an average stock (beta = 1.0)is zero.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 104

Related Exams