A) $637.15 per unit

B) $896.71 per unit

C) $721.00 per unit

D) $661.45 per unit

Correct Answer

verified

Correct Answer

verified

True/False

An activity cost pool in activity-based costing is a "cost bucket" in which costs related to a particular activity measure are accumulated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total overhead applied to Product T8 under activity-based costing is closest to:

A) $190,890

B) $168,578

C) $394,826

D) $435,683

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

A) $166.83 per MH

B) $88.96 per MH

C) $65.12 per MH

D) $192.54 per MH

Correct Answer

verified

Correct Answer

verified

Multiple Choice

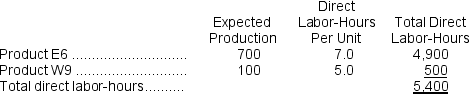

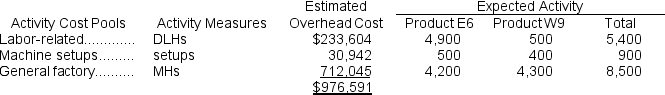

Moistner, Inc., manufactures and sells two products: Product E6 and Product W9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product E6 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product E6 would be closest to:

A) $586.39 per unit

B) $1,265.95 per unit

C) $302.82 per unit

D) $240.66 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

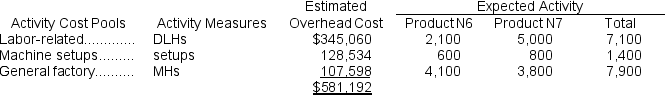

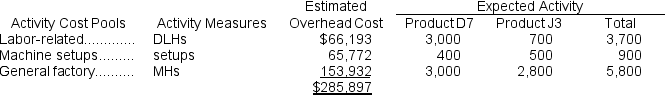

Boesenhofer, Inc., manufactures and sells two products: Product N6 and Product N7.The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The activity rate for the Machine Setups activity cost pool is closest to:

The activity rate for the Machine Setups activity cost pool is closest to:

A) $73.57 per setup

B) $91.81 per setup

C) $26.24 per setup

D) $28.32 per setup

Correct Answer

verified

Correct Answer

verified

True/False

When a company changes from a traditional costing system to an activity-based costing system, the unit product costs of high-volume products typically change more than the unit product costs of low-volume products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The overhead cost per unit of Product S under activity-based costing is closest to:

A) $5.00

B) $1.98

C) $10.00

D) $1.83

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product K8 would be closest to:

A) $68.20 per unit

B) $209.60 per unit

C) $439.00 per unit

D) $356.45 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the unit product cost of Product N0 is true?

A) The unit product cost of Product N0 under traditional costing is less than its unit product cost under activity-based costing by $3,494.65.

B) The unit product cost of Product N0 under traditional costing is greater than its unit product under activity-based costing by $3,494.65.

C) The unit product cost of Product N0 under traditional costing is less than its unit product cost under activity-based costing by $337.28.

D) The unit product cost of Product N0 under traditional costing is greater than its unit product under activity-based costing by $337.28.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

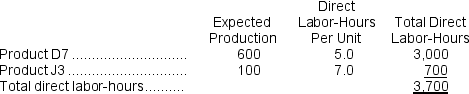

Matamoros, Inc., manufactures and sells two products: Product D7 and Product J3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product J3 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product J3 would be closest to:

A) $185.78 per unit

B) $511.56 per unit

C) $540.89 per unit

D) $125.23 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The overhead applied to each unit of Product J8 under activity-based costing is closest to:

A) $629.91 per unit

B) $723.78 per unit

C) $740.39 per unit

D) $405.73 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The overhead applied to each unit of Product G1 under activity-based costing is closest to:

A) $780.12 per unit

B) $866.76 per unit

C) $830.79 per unit

D) $380.33 per unit

Correct Answer

verified

Correct Answer

verified

Essay

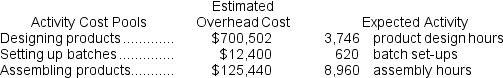

Kretlow Corporation has provided the following data from its activity-based costing accounting system:  Required:

Compute the activity rates for each of the three cost pools.Show your work!

Required:

Compute the activity rates for each of the three cost pools.Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that actual activity turns out to be the same as expected activity, the total amount of overhead cost allocated to Product X would be closest to:

A) $371,700

B) $387,000

C) $268,300

D) $149,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the wall mirrors is closest to:

A) $2,449

B) $4,144

C) $3,499

D) $3,062

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The overhead applied to each unit of Product Y1 under activity-based costing is closest to:

A) $1,322.49 per unit

B) $1,630.44 per unit

C) $1,424.59 per unit

D) $1,007.64 per unit

Correct Answer

verified

Correct Answer

verified

True/False

Unit-level activities are performed each time a new departmental unit such as a regional sales office is created.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

A) $34.33 per DLH

B) $15.39 per DLH

C) $23.03 per DLH

D) $78.28 per DLH

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unit product cost of Product N0 under activity-based costing is closest to:

A) $2,525.39 per unit

B) $2,434.27 per unit

C) $2,042.37 per unit

D) $2,996.06 per unit

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 230

Related Exams