A) If a bond trades at a premium,its yield to maturity will exceed its coupon rate.

B) A bond that trades at a premium is said to trade above par.

C) When a coupon-paying bond is trading at a premium,an investor's return from the coupons is diminished by receiving a face value less than the price paid for the bond.

D) Holding fixed the bond's yield to maturity,for a bond not trading at par,the present value of the bond's remaining cash flows changes as the time to maturity decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

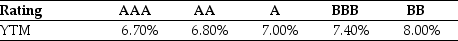

The credit spread on BBB-rated corporate bonds is:

A) 1.0%

B) 1.5%

C) 2.5%

D) 4.1%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following formulas is INCORRECT?

A) Invoice price = dirty price

B) Clean price = dirty price - accrued interest

C) Accrued interest = coupon amount × ![]()

D) Cash price = clean price + accrued interest

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price today of a three-year default-free security with a face value of $1000 and an annual coupon rate of 4% is closest to:

A) $1002.78

B) $1003.31

C) $1028.50

D) $1028.61

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The YTM of a 3 year default free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

A) 5.5%

B) 5.8%

C) 5.7%

D) 5.2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) The forward rate for year 1 is the rate on an investment that starts today and is repaid in one year;it is equivalent to an investment in a one-year zero-coupon bond.

B) The forward rate is only a good predictor of spot interest rates in the future when investors are risk adverse.

C) We can use the law of one price to calculate the forward rate from the zero-coupon yield curve.

D) An interest rate forward contract is a contract today that fixes the interest rate for a loan or investment in the future.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a bond that pays annually an 8% coupon with 20 years to maturity.The percentage change in the price of the bond if its yield to maturity increases from 5% to 7% is closest to:

A) 22%

B) 24%

C) -22%

D) -24%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) Bonds are a securities sold by governments and corporations to raise money from investors today in exchange for promised future payments.

B) By convention the coupon rate is expressed as an effective annual rate.

C) Bonds typically make two types of payments to their holders.

D) The time remaining until the repayment date is known as the term of the bond.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information for the question(s) below. The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years.The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually. -How much will each semiannual coupon payment be?

A) $60

B) $40

C) $120

D) $80

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that Luther's bonds receive a AAA rating,the number of bonds that Luther must issue to raise the needed $25 million is closest to:

A) 24,655

B) 25,000

C) 24,477

D) 26,681

Correct Answer

verified

Correct Answer

verified

Multiple Choice

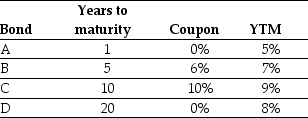

The amount that the price of bond "D" will change if its yield to maturity increases from 8% to 9% is closest to:

A) -$36

B) -$39

C) $36

D) $9

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:  -The percentage change in the price of the bond "C" if its yield to maturity increases from 9% to 10% is closest to:

-The percentage change in the price of the bond "C" if its yield to maturity increases from 9% to 10% is closest to:

A) -17%

B) -6%

C) -4%

D) 4%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) Forward rates tend not to be good predictors of future spot rates.

B) Given the risk associated with interest rate changes,corporate managers require tools to help manage this risk.

C) One of the most important tools to manage the risk of interest rate changes are interest rate forward contracts.

D) A spot rate is an interest rate that we can guarantee today for a loan or investment that will occur in the future.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information for the question(s) below.

Luther Industries needs to raise $25 million to fund a new office complex.The company plans on issuing ten-year bonds with a face value of $1000 and a coupon rate of 7.0% (annual payments) .The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  -Assuming that Luther's bonds receive a AAA rating,the price of the bonds will be closest to:

-Assuming that Luther's bonds receive a AAA rating,the price of the bonds will be closest to:

A) $1021

B) $1014

C) $1000

D) $937

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) The bond certificate typically specifies that the coupons will be paid periodically until the maturity date of the bond.

B) The bond certificate indicates the amounts and dates of all payments to be made.

C) The only cash payments the investor will receive from a zero coupon bond are the interest payments that are paid up until the maturity date.

D) Usually the face value of a bond is repaid at maturity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information for the question(s) below. The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years.The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually. -Assuming the appropriate YTM on the Sisyphean bond is 7.5%,then this bond will trade at

A) par.

B) a discount.

C) a premium.

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate bond which receives a BBB rating from Standard and Poor's is considered:

A) a junk bond.

B) an investment grade bond.

C) a defaulted bond.

D) a high-yield bond.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The YTM of a 4 year default free security with a face value of $1000 and an annual coupon rate of 5.25% is closest to:

A) 5.2%

B) 5.0%

C) 4.9%

D) 5.25%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a bond that pays annually an 8% coupon with 20 years to maturity.The amount that the price of the bond will change if its yield to maturity increases from 5% to 7% is closest to:

A) -$270

B) -$225

C) -$310

D) -$250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wyatt Oil is contemplating issuing a 20-year bond with semiannual coupons,a coupon rate of 7%,and a face value of $1000.Wyatt Oil believes it can get a BBB rating from Standard and Poor's for this bond issue.If Wyatt Oil is successful in getting a BBB rating,then the issue price for these bonds would be closest to:

A) $800

B) $891

C) $901

D) $1000

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 115

Related Exams