A) $91,979.50

B) $26.50

C) $20,537.50

D) $71,468.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

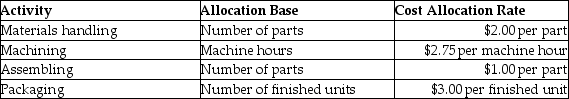

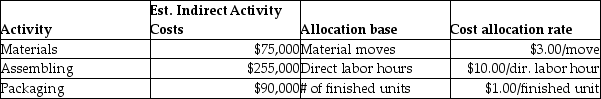

Kramer Company manufactures coffee tables and uses an activity-based costing system to allocate all manufacturing conversion costs.Each coffee table consists of 20 separate parts totaling $240 in direct materials,and requires 5.0 hours of machine time to produce.Additional information follows:

What is the total manufacturing cost per coffee table?

What is the total manufacturing cost per coffee table?

A) $316.75

B) $76.75

C) $313.75

D) $55.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

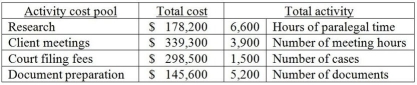

Salvatore LLC provides a wide variety of legal services and uses an activity-based costing system.Data from its activity-based costing system for all services follows:  The cost pool activity rate for client meetings is

The cost pool activity rate for client meetings is

A) $56 per meeting hour.

B) $8 per meeting hour.

C) $27 per meeting hour.

D) $87 per meeting hour.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

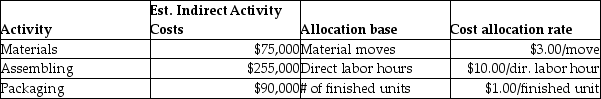

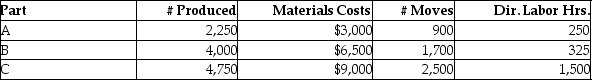

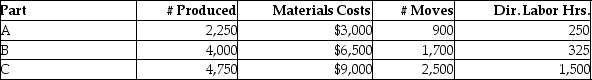

Hummingbird Manufacturing manufactures small parts and uses an activity-based costing system.

The following parts were produced in October with the following information:

The following parts were produced in October with the following information:

Total manufacturing costs for part B is

Total manufacturing costs for part B is

A) $8,350.

B) $12,350.

C) $14,850.

D) $18,850.

Correct Answer

verified

Correct Answer

verified

True/False

Merchandising and service companies,as well as governmental agencies,can use refined cost allocation systems to provide their managers with better cost information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hummingbird Manufacturing manufactures small parts and uses an activity-based costing system.

The following parts were produced in October with the following information:

The following parts were produced in October with the following information:

Total unit costs for Part A is closest to (round to two decimal points)

Total unit costs for Part A is closest to (round to two decimal points)

A) $4.64.

B) $12.14.

C) $7.63.

D) $4.71.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a cost item that should be classified as an external failure cost?

A) Tooling changes

B) Cost of a lost unit

C) Warranty claims

D) Cost to redesign product

Correct Answer

verified

Correct Answer

verified

True/False

Lean thinking involves carrying large amounts of inventory "just in case" something goes wrong.

Correct Answer

verified

Correct Answer

verified

True/False

ABC can be used in routine planning and control decisions as well as pricing,product mix and cost cutting decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

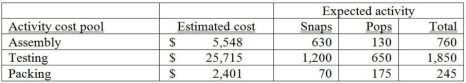

Alexander Inc.uses activity-based costing.The company produces two products: Snaps and Pops.The expected annual production of Snaps is 1,500 units,while the expected annual production of Pops is 2,200 units.There are three activity cost pools: Assembly,Testing,and Packing.The estimated costs and activities for each of these three activity pools follows:  The cost pool activity rate for Testing would be

The cost pool activity rate for Testing would be

A) $21.43 per activity.

B) $13.90 per activity.

C) $39.56 per activity.

D) $6.95 per activity.

Correct Answer

verified

Correct Answer

verified

True/False

Unit-level activities and costs are incurred for every single unit.

Correct Answer

verified

Correct Answer

verified

True/False

Companies that use departmental overhead rates trace direct materials and direct labor to cost objects just as they would in a traditional costing system.

Correct Answer

verified

Correct Answer

verified

True/False

The cost to design and market new models would be considered a facility-level cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When calculating the total amount of manufacturing overhead to allocate to a particular job,the company would multiply each departmental overhead rate by ________ and then ________ together the allocated amounts from each department.

A) the actual amount of the departmental allocation based used by the job;multiply

B) the actual amount of the plantwide allocation based used by the job;add

C) the actual amount of the departmental allocation based used by the job;add

D) the actual amount of the plantwide allocation based used by the job;multiply

Correct Answer

verified

Correct Answer

verified

True/False

It is easier to allocate indirect costs to the products that actually caused those costs if an ABC system is used rather than a traditional costing system.

Correct Answer

verified

Correct Answer

verified

True/False

Cost distortion occurs when some products are overcosted while other products are undercosted by the cost allocation system.

Correct Answer

verified

Correct Answer

verified

True/False

Product testing is an appraisal cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regarding activity-based costing systems,which of the following statements is true?

A) ABC systems accumulate overhead costs by departments.

B) ABC costing systems are less complex and,therefore,less costly than traditional systems.

C) ABC costing systems have separate indirect cost allocation rates for each activity.

D) ABC costing systems can be used in manufacturing firms only.

Correct Answer

verified

Correct Answer

verified

True/False

The estimated total manufacturing overhead costs that will be incurred in each department in the coming year are often referred to as activity cost pools.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

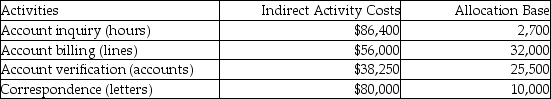

Potter & Weasley Company had the following activities,estimated indirect activity costs,and allocation bases:

Potter & Weasley uses activity based costing.

The above activities are used by Departments P and Q as follows:

Potter & Weasley uses activity based costing.

The above activities are used by Departments P and Q as follows:

How much of the account inquiry cost will be assigned to Department Q?

How much of the account inquiry cost will be assigned to Department Q?

A) $6,400

B) $25,600

C) $12,800

D) $8,000

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 251

Related Exams