A) $147,000

B) $236,250

C) $168,000

D) $89,250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Camping Gear Company had 500 units of inventory on hand at the end of the year.These were recorded at a cost of $14 each using the last-in,first-out (LIFO) method.The current replacement cost is $10 per unit.The selling price charged by Camping Gear Company for each finished product is $17.As a result of recording the adjusting entry as per the lower-of-cost-or-market rule,the gross profit will ________.

A) increase by $5,000

B) decrease by $5,000

C) increase by $2,000

D) decrease by $2,000

Correct Answer

verified

Correct Answer

verified

True/False

First Street Merchandisers has total cost of goods sold of $54,500,total beginning inventory of $18,500,and total ending inventory of $22,100.Cost of goods available for sale is $73,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inventory costs are declining,which of the following inventory costing method will result in the lowest ending merchandise inventory?

A) first-in,first-out

B) last-in,first-out

C) weighted-average

D) specific identification

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company that uses the periodic inventory system provided the following information: 1.Beginning inventory $5,000 2) Purchases $140,000 3) Purchase discounts $2,300 4) Purchase returns and allowances $600 At the end of the period,the physical count of inventory reveals that $15,000 worth of inventory is on hand.What is the amount of cost of goods sold?

A) $127,100

B) $142,100

C) $157,100

D) $137,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following principles states that a business's financial statements must report enough information for outsiders to make knowledgeable decisions about the company?

A) conservatism

B) materiality concept

C) disclosure principle

D) consistency principle

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that costs are changing during the accounting period,under the last-in,first-out inventory costing method,the amount of cost of goods sold calculated using the perpetual inventory system will usually differ from the amount calculated using the periodic inventory system.

Correct Answer

verified

Correct Answer

verified

True/False

Under International Financial Reporting Standards (IFRS),companies may only use the specific identification,FIFO,and weighted-average methods to cost inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

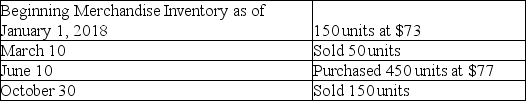

Rally Wheels Company had the following balances and transactions during 2018:  What would the company's ending merchandise inventory cost be on December 31,2018 if the perpetual inventory system and the last-in,first-out inventory costing method are used?

What would the company's ending merchandise inventory cost be on December 31,2018 if the perpetual inventory system and the last-in,first-out inventory costing method are used?

A) $15,200

B) $45,600

C) $30,400

D) $34,650

Correct Answer

verified

Correct Answer

verified

Multiple Choice

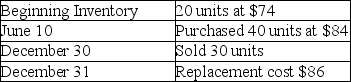

Boulevard Home Furnishings had the following balances and transactions during 2018.  The company maintains its records of inventory on a perpetual basis using the FIFO inventory costing method.Calculate the amount of ending Merchandise Inventory at December 31,2018 using the lower-of-cost-or-market rule.

The company maintains its records of inventory on a perpetual basis using the FIFO inventory costing method.Calculate the amount of ending Merchandise Inventory at December 31,2018 using the lower-of-cost-or-market rule.

A) $2,520

B) $2,580

C) $3,440

D) $5,160

Correct Answer

verified

Correct Answer

verified

True/False

An overstatement of ending merchandise inventory in the current period results in an understatement of net income in the current period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct formula to calculate average merchandise inventory?

A) Average merchandise inventory = (Beginning merchandise inventory - Ending merchandise inventory) / 2

B) Average merchandise inventory = (Beginning merchandise inventory × Ending merchandise inventory) / 2

C) Average merchandise inventory = (Beginning merchandise inventory / Ending merchandise inventory) / 2

D) Average merchandise inventory = (Beginning merchandise inventory + Ending merchandise inventory) / 2

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased 200 units for $30 each on January 31.It purchased 220 units for $33 each on February 28.It sold a total of 350 units for $45 each from March 1 through December 31.What is the cost of ending inventory on December 31 if the company uses the first-in,first-out (FIFO) inventory costing method? (Assume that the company uses a perpetual inventory system. )

A) $2,310

B) $300

C) $2,100

D) $1,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ending Merchandise Inventory for the current accounting period is understated by $2,700.What effect will this error have on Cost of Goods Sold and Net Income for the current accounting period?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

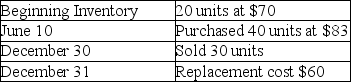

Delaware Retail Company had the following balances and transactions during 2019.  The company maintains its records of inventory on a perpetual basis using the last-in,first-out inventory costing method.Calculate the amount of ending Merchandise Inventory at December 31,2019 using the lower-of-cost-or-market rule.

The company maintains its records of inventory on a perpetual basis using the last-in,first-out inventory costing method.Calculate the amount of ending Merchandise Inventory at December 31,2019 using the lower-of-cost-or-market rule.

A) $2,490

B) $2,400

C) $1,800

D) $3,600

Correct Answer

verified

Correct Answer

verified

True/False

The total cost spent on inventory that was available to be sold during a period is called the cost of goods sold.

Correct Answer

verified

Correct Answer

verified

True/False

An inventory error cancels out after two periods.

Correct Answer

verified

Correct Answer

verified

True/False

The consistency principle states that businesses should report the same amount of ending merchandise inventory from period to period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an application of conservatism?

A) reporting inventory at the lower of cost or market

B) reporting only material amounts in the financial statements

C) reporting all relevant information in the financial statements

D) using the same depreciation method from period to period

Correct Answer

verified

Correct Answer

verified

True/False

Given the same purchase and sales data,and assuming the cost of inventory is rising,the costing methods for inventory will result in different amounts for net income.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 199

Related Exams