A) $-0-

B) $20,000

C) $12,000

D) $8,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The internal rate of return is defined as

A) a blend of the costs of capital from all sources.

B) the minimal acceptable interest rate on investments.

C) the difference between the present value of the cash inflows and outflows associated with a project.

D) the interest rate that sets the present value of a project's cash inflows equal to the present value of a project's cost.

Correct Answer

verified

Correct Answer

verified

Essay

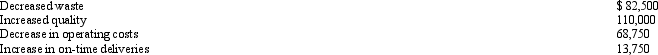

Wastenot Production Company is considering the purchase of a flexible manufacturing system. The after-tax cash benefits/savings associated with the system are as follows:

The system will cost $825,000 and will last ten years.

The company's cost of capital is 10 percent.

Required:

The system will cost $825,000 and will last ten years.

The company's cost of capital is 10 percent.

Required:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects that if accepted or rejected do NOT affect the cash flows of projects are called:

A) Dependent projects

B) Mutually exclusive projects

C) Independent projects

D) Both b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting rate of return on original investment is calculated as

A) original investment/net income.

B) net income/debt.

C) average income/original investment.

D) assets/debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of $10,000 to be received each year for ten years and earning a 14 percent return (rounded) is

A) $11,600.

B) $26,000.

C) $52,160.

D) $52,436.

Correct Answer

verified

Correct Answer

verified

True/False

The accounting rate of return considers the profitability of a project as well as the time value of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

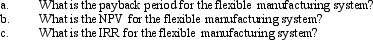

The following information pertains to an investment by the Town of Sutton:  Ignore income taxes. The present value of the salvage value (rounded) is

Ignore income taxes. The present value of the salvage value (rounded) is

A) $5,738.

B) $4,848.

C) $6,228.

D) $6,448.

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return (IRR) is the interest rate that sets the present value of cash inflows of a project equal to the present value of a project's cost.

Correct Answer

verified

Correct Answer

verified

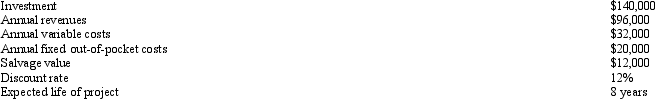

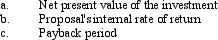

Essay

Absentia Company is evaluating a capital expenditure proposal that has the following predicted cash flows:

Required:

Determine the following values:

Required:

Determine the following values:

Correct Answer

verified

Correct Answer

verified

True/False

Independent projects directly affect the cash flows of other projects once accepted or rejected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Information about a project Dalwhinnie Company is considering is as follows:  The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the property at the end of the sixth year. No salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the property at the end of the sixth year. No salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

A) $80,000.

B) $284,000.

C) $217,800.

D) $192,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is considering a project requiring an investment of $200,000. The project would generate an annual cash flow of $55,478 for the next five years. The company uses the straight-line method of depreciation with no mid-year convention. Ignore income taxes. The approximate internal rate of return for the project is

A) 9%.

B) 10%.

C) 12%.

D) 16%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heckrwee Industries is considering a project that would require an initial investment of $101,000. The project would result in cost savings of $62,000 in year 1 and $70,000 in year 2. The internal rate of return is

A) under 15%.

B) between 16% and 17%.

C) between 18% and 20%.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of $7,500 to be received each year for five years and earning an 10 percent return (rounded) is

A) $28,433.

B) $8,250.

C) $14,717.

D) $33,750.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chinchilla Company is considering the purchase of a new machine for $57,000. The machine would generate an annual cash flow of $18,228 for five years. At the end of five years, the machine would have no salvage value. The company's cost of capital is 12 percent. The company uses straight-line depreciation with no mid-year convention. What is the internal rate of return for the machine rounded to the nearest percent, assuming no taxes are paid?

A) 12%

B) 18%

C) 14%

D) 16%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the net present value is positive, it could signal

A) a return in excess of the initial investment or required rate of return has been received.

B) the required rate of return has not been achieved.

C) the initial investment has not been recovered.

D) a decrease in wealth for the firm.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Linda's Graphic Designs is considering the purchase of a used color Laser Printer costing $38,400. The Printer would generate an annual cash flow of $16,000 for three years. At the end of three years, the Printer would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation with no mid-year convention. What is the internal rate of return to the nearest percent for the Printer, assuming no taxes are paid?

A) 8%

B) 10%

C) 12%

D) 42%

Correct Answer

verified

Correct Answer

verified

True/False

Discounting models for making capital decisions ignore the time value of money.

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return (IRR) is the most widely used capital investment technique because it's an easily understood concept.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 126

Related Exams