A) $2,158,320

B) $5,995,333

C) $6,834,680

D) $8,993,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The margin of safety is equal to:

A) Sales - Net operating income.

B) Sales - (Variable expenses/Contribution margin) .

C) Sales - (Fixed expenses/Contribution margin ratio) .

D) Sales - (Variable expenses + Fixed expenses) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

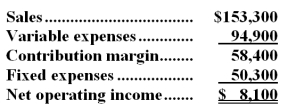

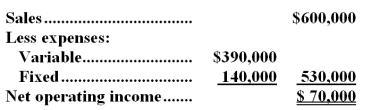

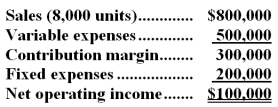

Faust Corporation has provided its contribution format income statement for August.  -The degree of operating leverage is closest to:

-The degree of operating leverage is closest to:

A) 18.93

B) 0.14

C) 0.05

D) 7.21

Correct Answer

verified

Correct Answer

verified

Multiple Choice

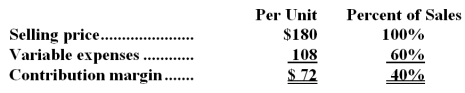

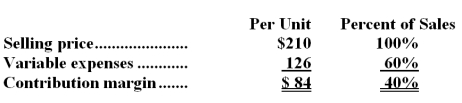

Similien Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $300,000 per month.The company is currently selling 5,000 units per month.The marketing manager would like to cut the selling price by $14 and increase the advertising budget by $17,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,400 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $300,000 per month.The company is currently selling 5,000 units per month.The marketing manager would like to cut the selling price by $14 and increase the advertising budget by $17,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,400 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $64,200

B) increase of $215,400

C) decrease of $64,200

D) decrease of $5,800

Correct Answer

verified

Correct Answer

verified

Essay

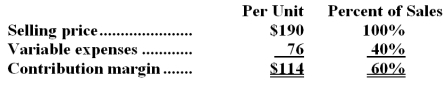

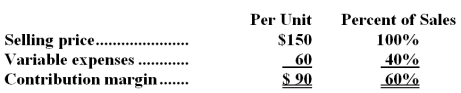

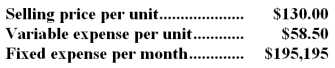

Data concerning Uthe Corporation's single product appear below:  Fixed expenses are $522,000 per month.The company is currently selling 6,000 units per month.

Required:

The marketing manager would like to cut the selling price by $19 and increase the advertising budget by $30,900 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,600 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Fixed expenses are $522,000 per month.The company is currently selling 6,000 units per month.

Required:

The marketing manager would like to cut the selling price by $19 and increase the advertising budget by $30,900 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,600 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Correct Answer

verified

Correct Answer

verified

True/False

On a CVP graph for a profitable company,the line representing total expenses is steeper than the line representing total revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

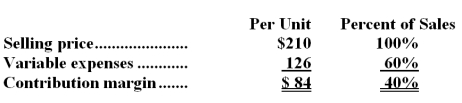

Wertman Corporation produces and sells a single product with the following characteristics:  The company is currently selling 3,000 units per month.Fixed expenses are $215,000 per month.Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Wertman Corporation.Refer to the original data when answering this question. Management is considering using a new component that would increase the unit variable cost by $5.Since the new component would increase the features of the company's product,the marketing manager predicts that monthly sales would increase by 200 units.What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 3,000 units per month.Fixed expenses are $215,000 per month.Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Wertman Corporation.Refer to the original data when answering this question. Management is considering using a new component that would increase the unit variable cost by $5.Since the new component would increase the features of the company's product,the marketing manager predicts that monthly sales would increase by 200 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $15,800

B) decrease of $15,800

C) increase of $800

D) decrease of $800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio of fixed expenses to the unit contribution margin is the:

A) break-even point in unit sales.

B) profit margin.

C) contribution margin ratio.

D) margin of safety.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mardist Corporation has sales of $100,000,variable expenses of $75,000,fixed expenses of $30,000,and a net loss of $5,000.How much would Mardist have to sell to achieve a profit of 10% of sales?

A) $187,500

B) $200,000

C) $225,500

D) $180,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Junsin Corporation's budget for next year appears below.The budget assumes the company will sell 30,000 units.  -The company's margin of safety as a percentage of sales (rounded to the nearest whole percent) is:

-The company's margin of safety as a percentage of sales (rounded to the nearest whole percent) is:

A) 33%

B) 50%

C) 12%

D) 67%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wertman Corporation produces and sells a single product with the following characteristics:  The company is currently selling 3,000 units per month.Fixed expenses are $215,000 per month.Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Wertman Corporation.Refer to the original data when answering this question. The marketing manager believes that a $7,000 increase in the monthly advertising budget would result in a 110 unit increase in monthly sales.What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 3,000 units per month.Fixed expenses are $215,000 per month.Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Wertman Corporation.Refer to the original data when answering this question. The marketing manager believes that a $7,000 increase in the monthly advertising budget would result in a 110 unit increase in monthly sales.What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $7,000

B) increase of $2,240

C) decrease of $2,240

D) increase of $9,240

Correct Answer

verified

Correct Answer

verified

True/False

At the break-even point,variable expenses and fixed expenses are equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

North Company sells a single product.The product has a selling price of $30 per unit and variable expenses of 70% of sales.If the company's fixed expenses total $60,000 per year,then it will have a break-even of:

A) $60,000

B) $85,714

C) $42,000

D) $200,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data concerning Grodi Corporation's single product appear below:  Fixed expenses are $324,000 per month.The company is currently selling 5,000 units per month.Management is considering using a new component that would increase the unit variable cost by $9.Since the new component would increase the features of the company's product,the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $324,000 per month.The company is currently selling 5,000 units per month.Management is considering using a new component that would increase the unit variable cost by $9.Since the new component would increase the features of the company's product,the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $4,500

B) decrease of $40,500

C) increase of $40,500

D) increase of $4,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Riven Corporation has a single product whose selling price is $10.At an expected sales level of $1,000,000,the company's variable expenses are $600,000 and its fixed expenses are $300,000.The marketing manager has recommended that the selling price be increased by 20%,with an expected decrease of only 10% in unit sales.What would be the company's net operating income if the marketing manager's recommendation is adopted?

A) $132,000

B) $290,000

C) $180,000

D) $240,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Faust Corporation has provided its contribution format income statement for August.  -If the company's sales increase by 10%,its net operating income should increase by about:

-If the company's sales increase by 10%,its net operating income should increase by about:

A) 5%

B) 72%

C) 10%

D) 189%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

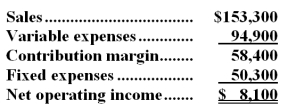

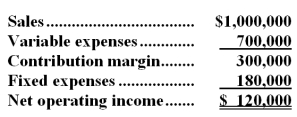

The following is last month's contribution format income statement:  What is the company's degree of operating leverage?

What is the company's degree of operating leverage?

A) 0.125

B) 8.0

C) 3.0

D) 0.333

Correct Answer

verified

Correct Answer

verified

Multiple Choice

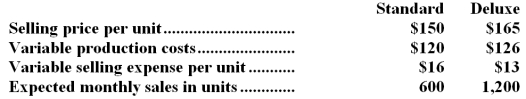

Hooper Corporation produces and sells two models of vacuum cleaners,Standard and Deluxe.The company records show the following monthly data relating to these two products:  The company's total monthly fixed cost is $15,000.

-If the expected monthly sales in units were divided equally between the two models (900 Standard and 900 Deluxe) ,the break-even level of sales would be:

The company's total monthly fixed cost is $15,000.

-If the expected monthly sales in units were divided equally between the two models (900 Standard and 900 Deluxe) ,the break-even level of sales would be:

A) the same as with the expected sales mix.

B) higher than with the expected sales mix.

C) lower than with the expected sales mix.

D) cannot be determined with the available data.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following is Addison Corporation's contribution format income statement for last month:  The company has no beginning or ending inventories.A total of 20,000 units were produced and sold last month.

-What is the company's margin of safety in dollars?

The company has no beginning or ending inventories.A total of 20,000 units were produced and sold last month.

-What is the company's margin of safety in dollars?

A) $400,000

B) $600,000

C) $120,000

D) $880,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Witting Corporation produces and sells a single product.Data concerning that product appear below:  The break-even in monthly unit sales is closest to:

The break-even in monthly unit sales is closest to:

A) 2,523

B) 1,502

C) 3,337

D) 2,730

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 214

Related Exams